Josh Hawley Is Against Court Injunctions Unless He's Not

The insurrectionist senator is upset about courts getting in the way of all-out authoritarianism.

Hey BFT folks, Denny here. Today's newsletter is brought to you by Travis Wright, who messaged me last week after I posted about Senator Josh Hawley appearing unable to pull off the bad-faith playacting that many of his colleagues have mastered in these bad faith times. Hawley last week during a Senate hearing tried to feign outrage over federal courts getting in the way of Trump's authoritarian takeover of the United States. Well, it turns out Hawley isn't against all injunctions. In fact, he's fond of one in particular. Here's Travis with more on the senator's egregious bad faith:

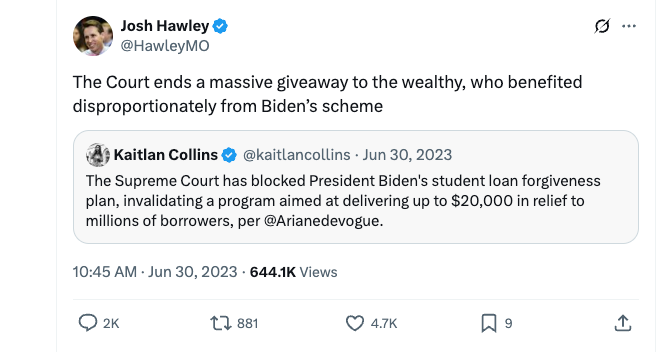

Josh Hawley hates court injunctions.

The insurrectionist senator from Missouri last week confronted a “flip-flopping liberal professor” – who dismantled him with a smile – during a Senate hearing on the subject of court injunctions that have, for now, offered hope that the judiciary might stop our slide into all-out authoritarianism. At the end of a video he shared of the interaction, Hawley lands what he believes to be a zinger: “You would have it be as simple as majority rule. When you get the majority you'd like, you're for the nationwide injunction; When you don't, you're not.”

It’s an interesting accusation. Surely, he feels this way all the time. Surely, the senator is a principled man. Surely, this isn’t a convenient bad-faith position that he holds selectively.

Ah, nevertheless. It is fair to point out that Hawley is championing action by the right-wing dominated Supreme Court here, and not some “rogue” federal court that rules against Donald Trump’s tyranny. But something else was going on around this time. In July 2023, the Biden administration took action on student loan repayment reform. As part of this action, the maximum amount of payments a person had to make was shortened in some instances. Here’s a helpful summary from the National Consumer Law Center:

At the same time, the Department transferred all borrowers who were enrolled in REPAYE [Revised Pay as You Earn] into SAVE [Saving on a Valuable Education], and allowed other borrowers to begin enrolling in SAVE.

In February 2024, the Department began implementing another portion of the SAVE plan that shortened the number of years some borrowers need to make payments to as few as 10 years of payments, and canceled 153,000 borrowers’ loans.

On July 1, 2024, the rest of the regulations were scheduled to go into effect. Those provisions included: Reducing monthly payments by half–from 10% of income to 5% of income–for loans that paid for a borrower’s undergraduate education on the SAVE plan; providing new options to allow borrowers to share their tax income with the Department of Education so that it is easier to enroll and stay enrolled in any income driven repayment plan without having to fill out a paper application; stopping interest capitalization when borrowers leave the ICR, PAYE, or SAVE plans; streamlining and improving aspects of all of the income driven repayment plans, like providing a common “family size” definition and providing credit for time spent in specific forbearances and deferments; allowing borrowers to keep credit towards IDR cancellation for payments made before they consolidated their loans.

The important thing to take from this is that people were automatically moved into the Saving on a Valuable Education (SAVE) plan or pushed to consider it because it lowered monthly payments substantially. And then things got stupid because of the injunctions Hawley claims to hate so much.

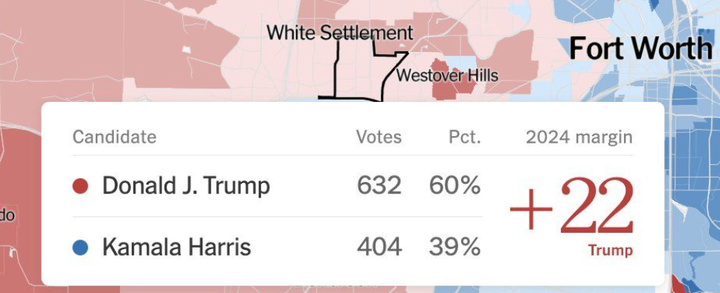

In spring 2024, two attorneys general challenged the SAVE plan in court. One of the challenges was led by Hawley's home state, Missouri. In their initial lawsuit, they argued that Missouri would be harmed because the Higher Education Loan Authority of the State of Missouri (MOHELA) would miss out on all of those sweet, sweet student loan servicing fees. It's absolutely depraved.

MOHELA faces the imminent loss of revenue in its role as a servicer of loans owned by the Federal Government. MOHELA’s revenue as a servicer of those loans is a function of the number of accounts it services. “MOHELA receives an administrative fee for each of the five million federal accounts it services”—now 7.7 million loans. See Biden, 143 S. Ct. at 2366. The Supreme Court determined that MOHELA suffers financial harm whenever loans that it services are discharged. Id. So when student loan balances go to zero, as they will under the Final Rule, MOHELA will lose the revenue from servicing those loans. Thus, by accelerating the forgiveness timeline for the typical borrower by as much as 15 years, the Final Rule imposes financial harm on MOHELA, and thus the State of Missouri, by depriving MOHELA of up to 15 years in servicing fees.

The lawsuit resulted in a nationwide injunction by the Eighth Circuit that caused all borrowers on the SAVE plan to be placed on an administrative forbearance. During this time, the borrowers have not accrued any interest, but they have also not been allowed to make payments. Therefore, they cannot accumulate on-time payments to make progress towards student loan forgiveness. They also can’t be discharged from MOHELA or other servicing providers, so the fees keep coming (seems like a government inefficiency to me but I am just a simple man; the DOGE boys seem uninterested). Importantly, the affected group includes individuals on the Public Service Loan Forgiveness (PSLF) plan.

PSLF is the result of a 2007 law that allows employees of non-profit organizations to have their loans forgiven after 120 on-time payments. As we enter month 12 of the involuntary administrative forbearance, folks who would have been eligible for forgiveness in June of 2025 are still 12 on-time payments away. For these individuals, the above injunction felt like they were cut off at the knees.

Unlike a lot of right-wing lawmakers, Hawley doesn't play the bad-faith game convincingly. You can tell he's doing a bit here. He doesn't actually believe anything he's saying. It makes it so much easier for Shaw to pick him apart.

— Denny Carter (@dennycarter.bsky.social) 2025-06-04T12:10:52.866Z

Imagine the feeling: You are just a few months away from loan forgiveness that may allow you to purchase a home or simply not have a massive looming debt and now…who knows? The PSLF program was in many of their Master Promissory Notes. In other words, the path was laid out when they signed the loan: Work in public service and make less money for ten years and we will pay back that investment with loan forgiveness.

The PSLF Subreddit is a hopeless place, as you might imagine. No one knows where things stand. Things have gotten especially dark as the Big Beautiful Bill has made its way through Congress. While there are organizations fighting for PSLF, it can feel hopeless when no one seems particularly motivated. Borrowers can request to “buy back” lost months but that is an online form that seems to float into the abyss. Clearly, MOHELA (one of the PSLF servicers) is completely unmotivated. They need those sweet fees. The discourse around PSLF is steeped in ignorance. Many see it as a new movement or idea like the Biden administration's other student loan initiatives. It isn’t, but you wonder if that matters to anyone.

Hawley seems fine with this court injunction. I wonder what’s different about it. The faith will remain bad until further notice.

Comments ()